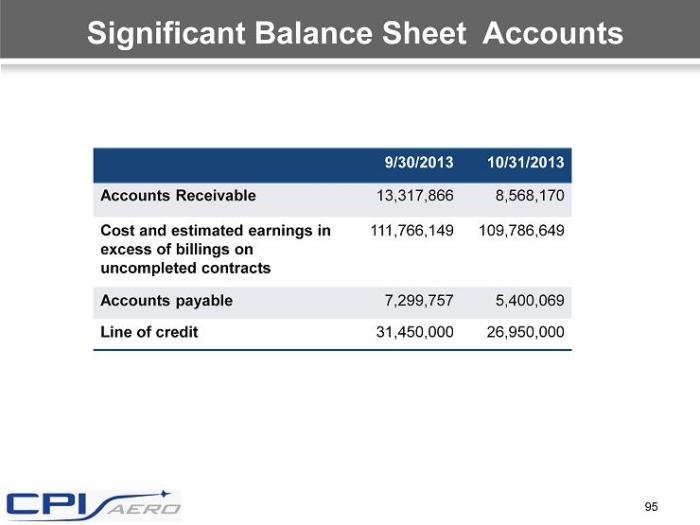

Cost and estimated earnings in excess of billings is a critical metric for businesses to understand and manage effectively. By optimizing costs, maximizing revenue, and improving profitability, businesses can unlock significant financial growth and success.

This comprehensive guide delves into the key components of cost and estimated earnings in excess of billings, providing practical strategies and insights to help businesses enhance their financial performance.

Cost Breakdown

Understanding the cost structure associated with excess earnings is crucial for optimizing profitability. Various cost components contribute to the total cost, including:

- Fixed Costs:These costs remain constant regardless of the level of activity, such as rent, salaries, and insurance.

- Variable Costs:These costs fluctuate with the level of activity, such as raw materials, commissions, and shipping.

Strategies for optimizing costs include:

- Negotiating lower prices with suppliers

- Improving operational efficiency

- Outsourcing non-core functions

Revenue Analysis

Identifying the sources of revenue that contribute to excess earnings is essential for maximizing revenue generation. Common sources of revenue include:

- Sales of goods or services

- Interest income

- Dividend income

Billing rates and volume significantly impact revenue. Increasing billing rates or volume can boost revenue, while decreasing them can have the opposite effect.

Methods for maximizing revenue generation include:

- Offering value-added services

- Expanding into new markets

- Optimizing pricing strategies

Profitability Assessment: Cost And Estimated Earnings In Excess Of Billings

Profitability assessment involves calculating the profit margin based on excess earnings. The profit margin is a measure of profitability, expressed as a percentage of revenue. A higher profit margin indicates higher profitability.

The relationship between cost and revenue in determining profitability is crucial. Optimizing costs and maximizing revenue both contribute to increased profitability.

Strategies for improving profitability include:

- Reducing unnecessary expenses

- Increasing sales volume

- Improving operational efficiency

Financial Forecasting

Financial forecasting is essential for predicting future excess earnings and making informed decisions. Creating a financial model that incorporates key assumptions and variables can help forecast future excess earnings.

Key assumptions and variables that influence the forecast include:

- Economic conditions

- Industry trends

- Cost and revenue projections

Accurate forecasting is crucial for making informed decisions regarding resource allocation, investments, and financial planning.

Data Management

Designing a data management system to track and analyze excess earnings is vital for effective decision-making. Relevant metrics and key performance indicators (KPIs) should be identified to measure progress and identify areas for improvement.

Data analysis can support decision-making by:

- Identifying trends and patterns

- Evaluating the effectiveness of strategies

- Making informed predictions

Reporting and Communication

Creating a reporting template to present excess earnings to stakeholders is essential for effective communication. Different reporting formats serve different purposes and audiences.

Best practices for communicating financial information include:

- Using clear and concise language

- Highlighting key financial metrics

- Providing context and explanations

Regulatory Compliance

Identifying any regulatory requirements related to excess earnings is crucial for ensuring compliance. Non-compliance can result in penalties, fines, or legal action.

Guidance on ensuring compliance includes:

- Understanding applicable laws and regulations

- Maintaining accurate records

- Seeking professional advice when necessary

Case Studies

Examining case studies of businesses that have successfully managed excess earnings can provide valuable insights. Understanding the strategies and tactics they employed can help identify best practices and common challenges.

Lessons learned from case studies can include:

- Effective cost optimization techniques

- Revenue generation strategies

- Profitability improvement measures

Common Queries

What are the key cost components associated with excess earnings?

Fixed costs (e.g., rent, salaries) and variable costs (e.g., raw materials, commissions) are the primary cost components.

How can businesses optimize costs?

Negotiating with suppliers, implementing cost-saving technologies, and optimizing production processes are effective cost optimization strategies.

What are the main sources of revenue that contribute to excess earnings?

Sales of products or services, interest income, and investment returns are common sources of revenue.

How can businesses maximize revenue generation?

Increasing sales volume, adjusting pricing strategies, and expanding into new markets are effective revenue maximization techniques.

What is the importance of accurate financial forecasting?

Accurate forecasting helps businesses make informed decisions, plan for future growth, and manage risks effectively.