After tax post liquidation return cfa – In the realm of investment analysis, the concept of after-tax post-liquidation return holds significant importance. This metric, commonly abbreviated as ATPLR, provides a comprehensive measure of an investment’s performance after considering the impact of taxes and liquidation costs. Understanding and accurately calculating ATPLR is essential for CFA candidates and investment professionals alike, as it enables informed decision-making and portfolio optimization.

This guide delves into the intricacies of ATPLR, exploring its definition, calculation methods, influencing factors, applications, limitations, and comparison with other investment performance metrics. By gaining a thorough understanding of ATPLR, readers will be well-equipped to evaluate investment options, optimize their portfolios, and make sound financial decisions.

Definition of After-Tax Post-Liquidation Return

After-tax post-liquidation return (ATPLR) measures the net return an investor receives after selling an investment and paying all applicable taxes and fees. It represents the actual return realized by the investor after accounting for the impact of taxes.

ATPLR is a crucial metric for investment analysis as it provides a more accurate assessment of an investment’s performance compared to pre-tax returns. It helps investors make informed decisions by considering the actual amount of return they will receive after considering tax implications.

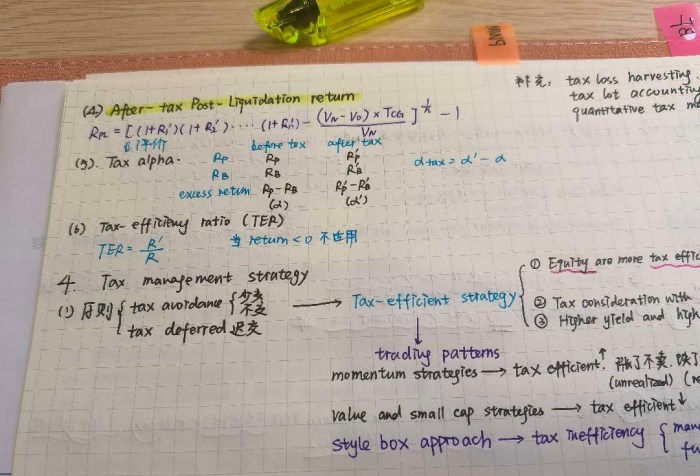

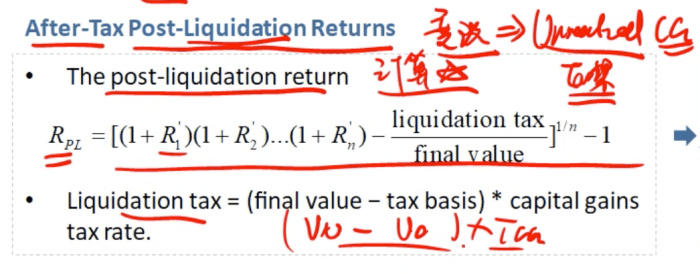

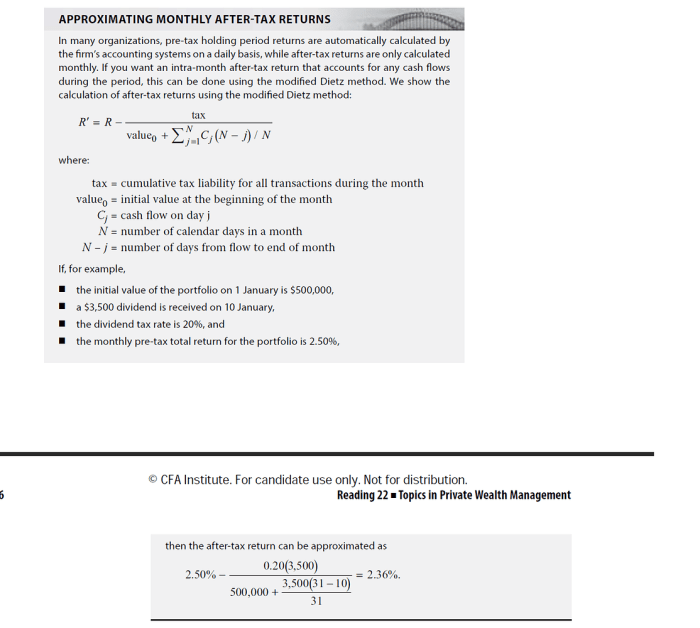

Calculation of After-Tax Post-Liquidation Return: After Tax Post Liquidation Return Cfa

To calculate ATPLR, follow these steps:

- Determine the proceeds from the sale of the investment.

- Calculate the capital gains or losses by subtracting the cost basis from the proceeds.

- Identify the applicable tax rate based on the type of investment and holding period.

- Multiply the capital gains by the tax rate to calculate the taxes owed.

- Subtract the taxes owed from the proceeds to get the after-tax proceeds.

- Divide the after-tax proceeds by the initial investment to calculate the ATPLR.

Factors Influencing After-Tax Post-Liquidation Return

- Investment strategy:Different investment strategies have varying tax implications. For example, investments in tax-advantaged accounts, such as 401(k)s and IRAs, offer tax deferral or tax-free growth.

- Asset allocation:The mix of different asset classes in a portfolio can impact ATPLR. Investments in growth-oriented assets, such as stocks, tend to have higher potential capital gains and thus higher ATPLR.

- Tax rates:The applicable tax rates play a significant role in determining ATPLR. Investors in higher tax brackets will have a lower ATPLR compared to those in lower tax brackets.

- Investment fees:Investment fees, such as management fees and sales charges, can reduce ATPLR by decreasing the proceeds received by the investor.

Comparison of After-Tax Post-Liquidation Return to Other Metrics

ATPLR should be compared to other investment performance metrics to provide a comprehensive evaluation:

- Pre-tax return:Pre-tax return represents the return on investment before considering taxes. It provides a baseline for comparison but does not account for the impact of taxes.

- Internal rate of return (IRR):IRR is a discount rate that equates the present value of future cash flows to the initial investment. It considers the time value of money but does not account for taxes.

Applications of After-Tax Post-Liquidation Return, After tax post liquidation return cfa

ATPLR has practical applications in investment decision-making:

- Evaluating investment options:ATPLR helps investors compare the net returns of different investment options after considering taxes.

- Optimizing portfolios:By understanding the ATPLR of different assets, investors can optimize their portfolios to maximize after-tax returns.

- Planning for retirement:ATPLR is essential for planning retirement income, as it provides a more accurate estimate of the actual return investors will receive after taxes.

Limitations of After-Tax Post-Liquidation Return

ATPLR has some limitations:

- Assumes constant tax rates:ATPLR assumes that tax rates will remain constant throughout the investment period, which may not be the case.

- Ignores inflation:ATPLR does not account for inflation, which can erode the real value of returns.

- May not capture all tax implications:ATPLR may not capture all potential tax implications, such as state and local taxes or alternative minimum tax.

Answers to Common Questions

What is the purpose of calculating ATPLR?

ATPLR helps investors assess the actual return they will receive after considering the impact of taxes and liquidation costs. It provides a more realistic measure of investment performance compared to pre-tax returns.

How is ATPLR calculated?

ATPLR is calculated using the following formula: ATPLR = (Ending Value – Initial Value – Taxes – Liquidation Costs) / Initial Value.

What factors influence ATPLR?

ATPLR is influenced by factors such as investment strategy, asset allocation, tax rates, investment holding period, and liquidation fees.

How does ATPLR compare to other investment performance metrics?

ATPLR provides a more comprehensive measure of investment performance compared to pre-tax return, which does not consider the impact of taxes. It is also different from IRR, which assumes reinvestment of returns at a constant rate.